368 Sample Acknowledgement Letter For Donation

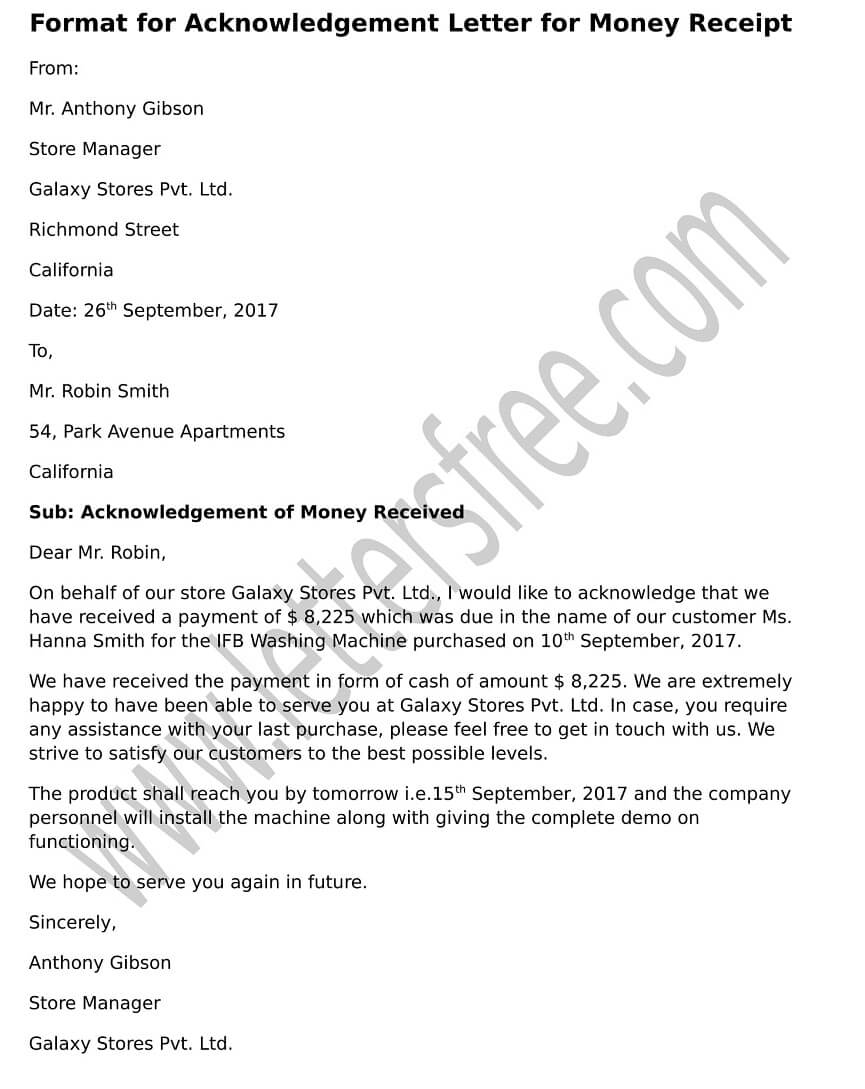

Another name for acknowledgment letters is a letter of receipt.

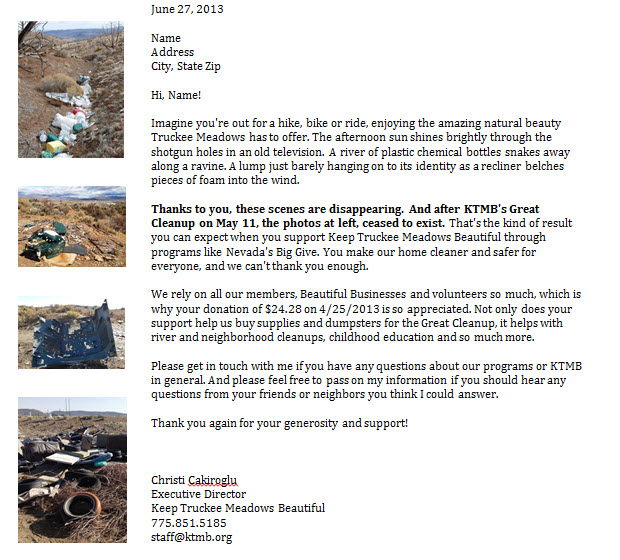

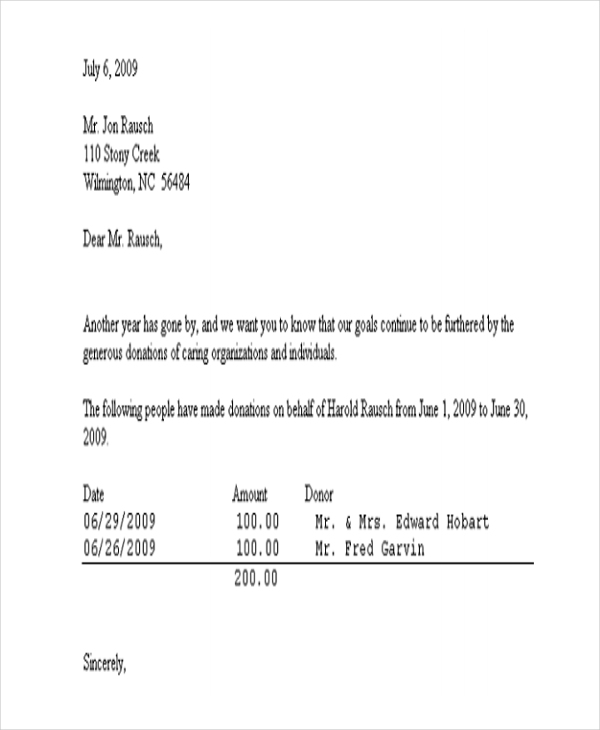

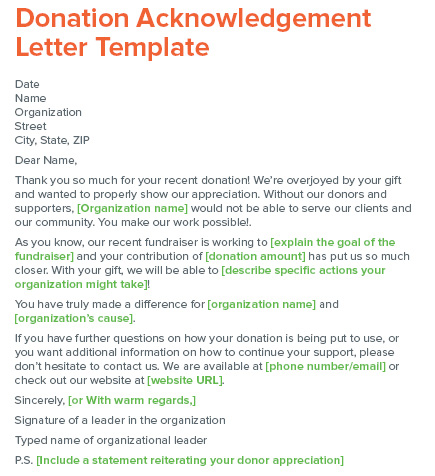

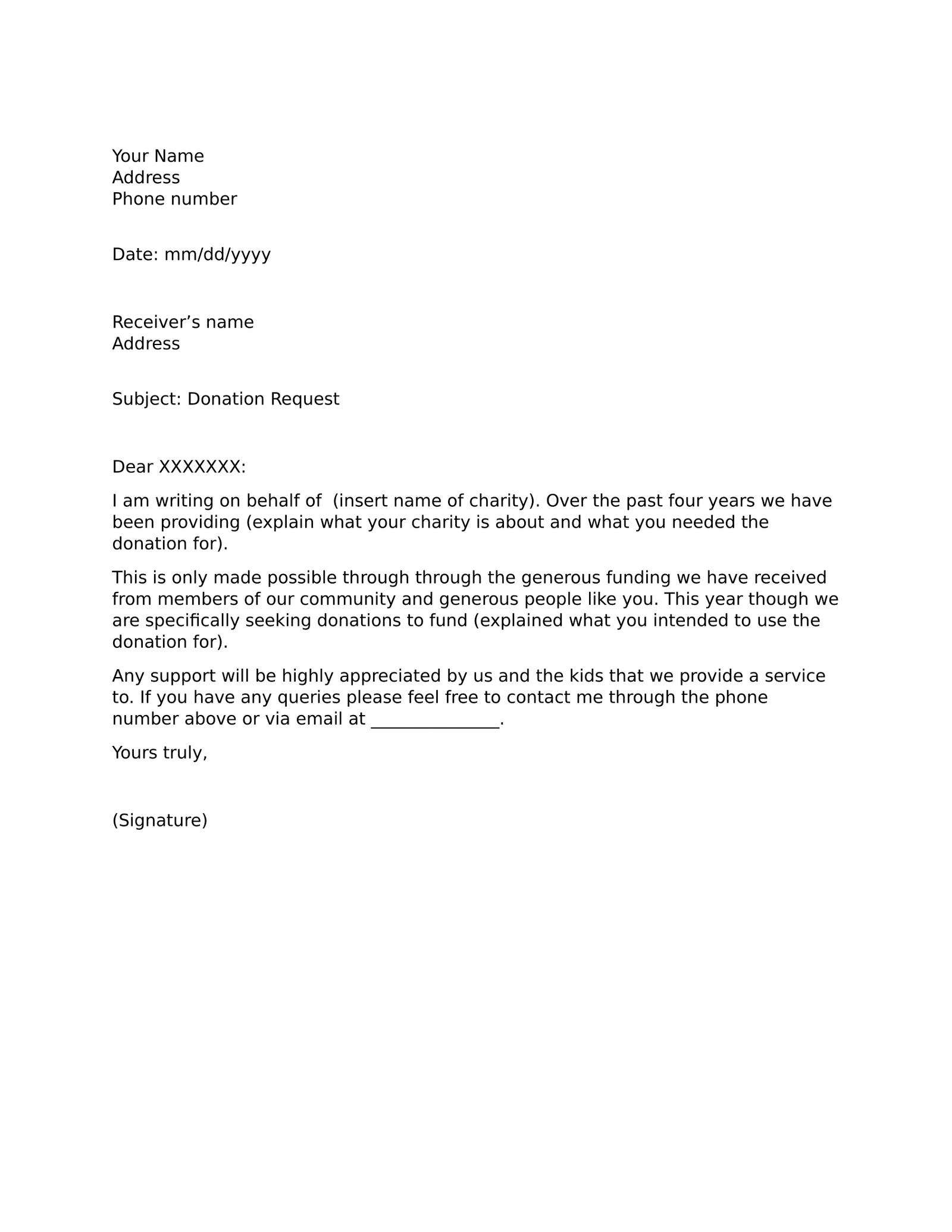

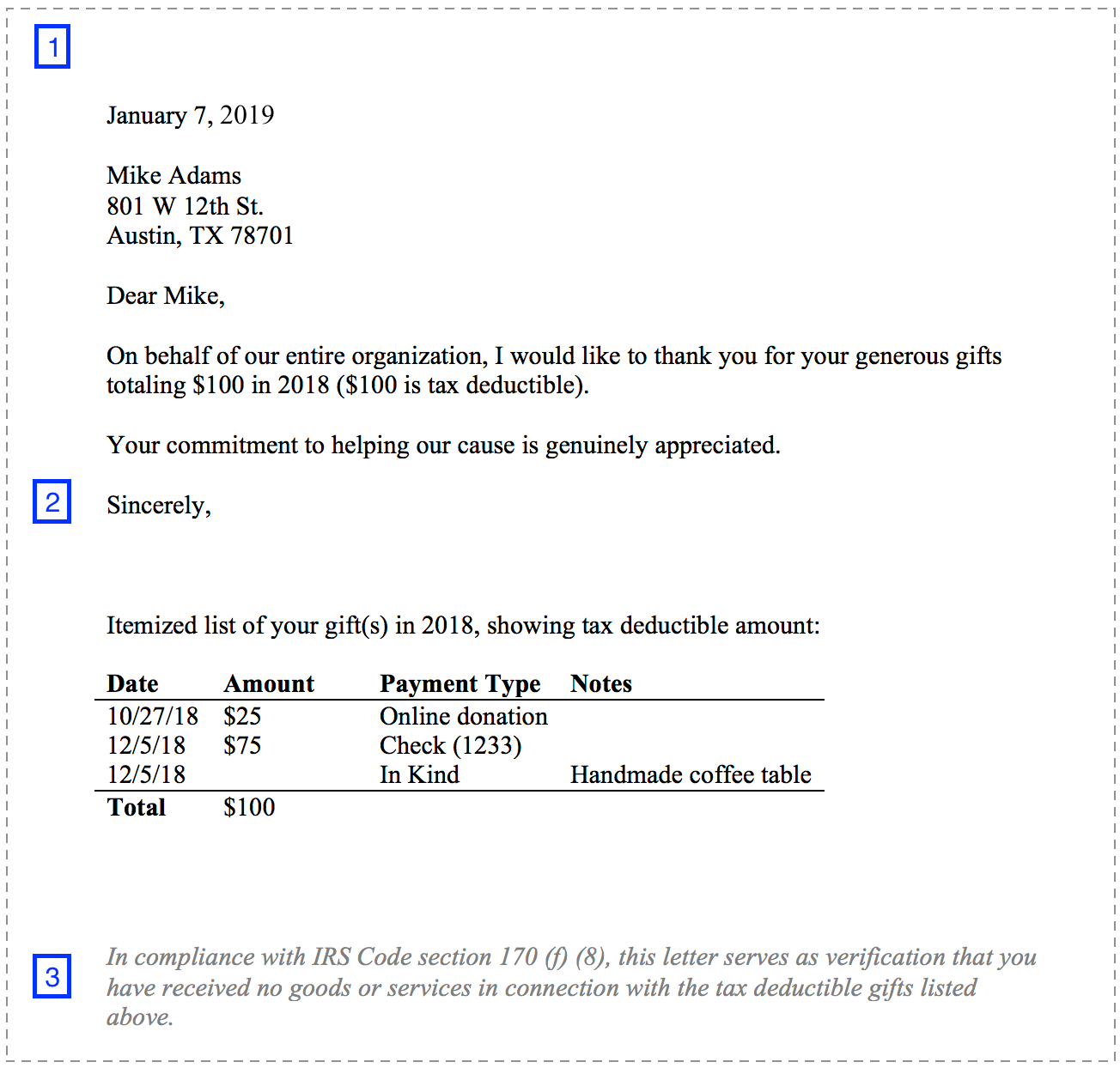

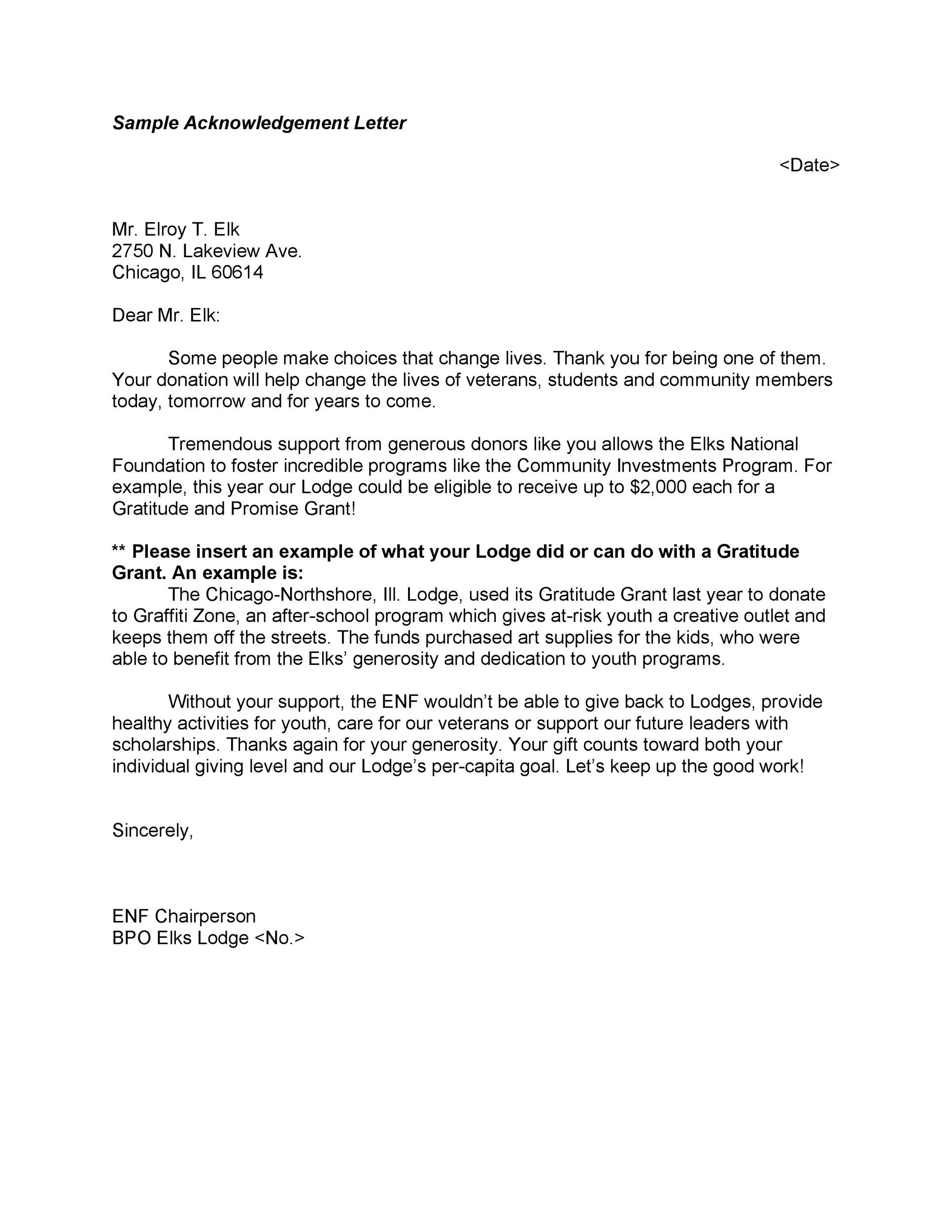

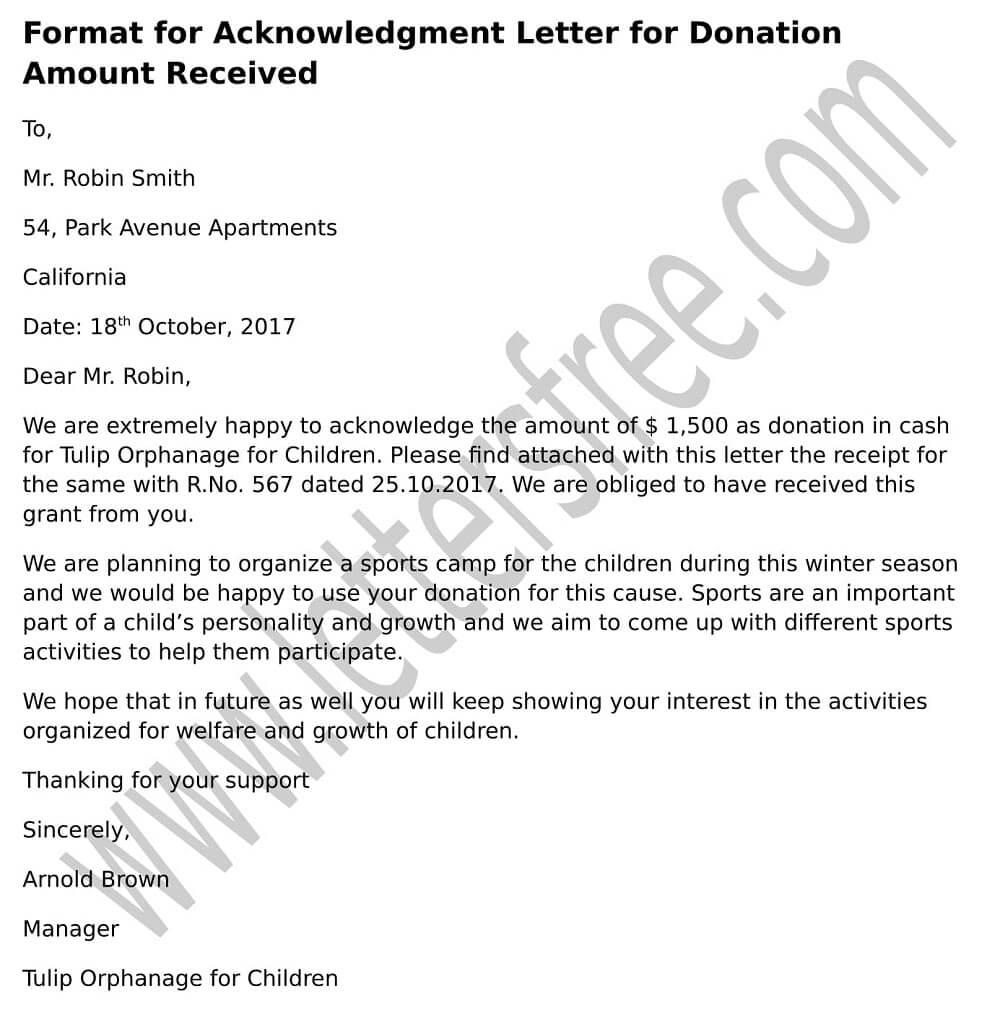

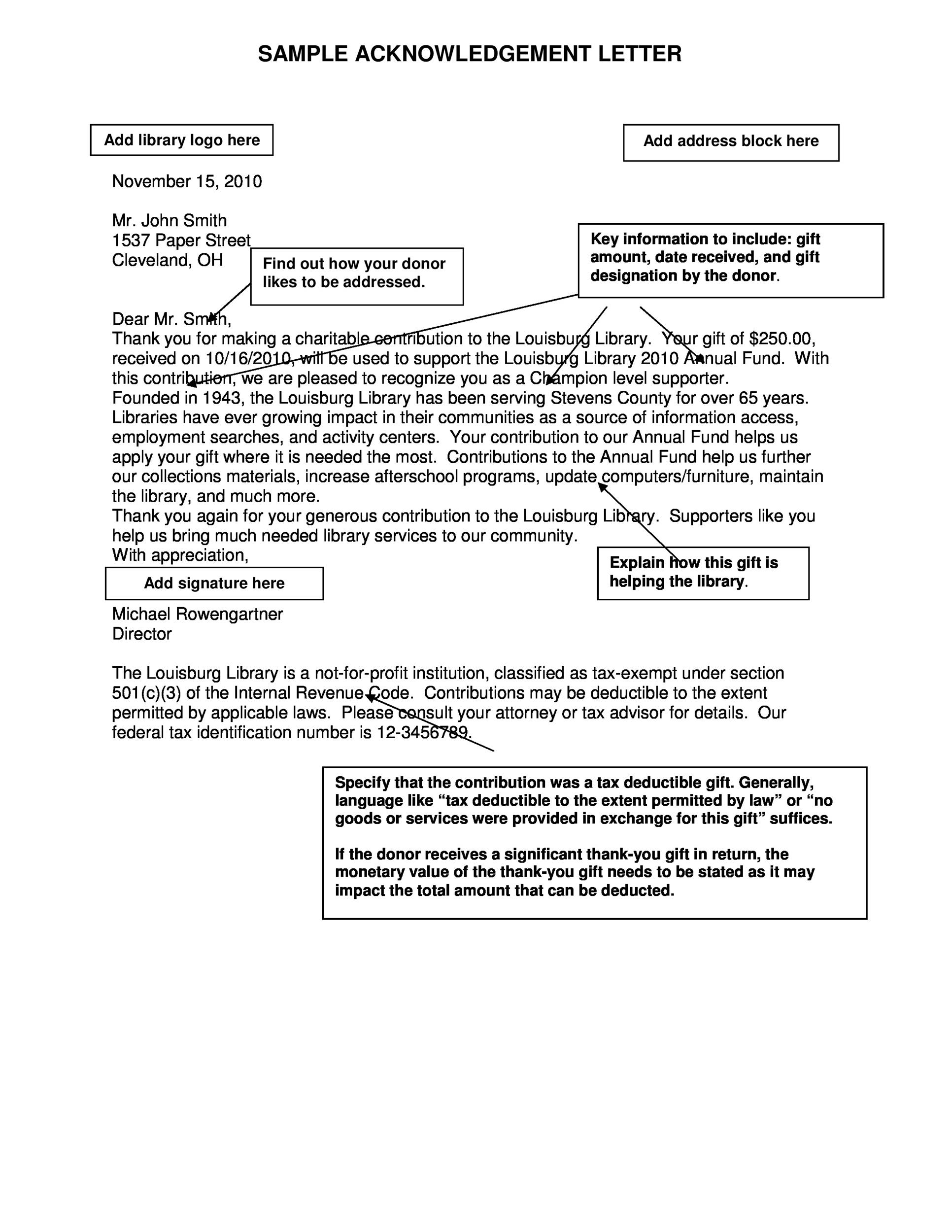

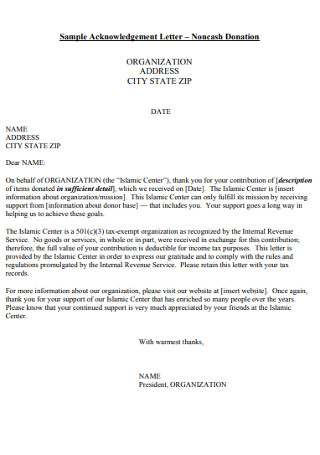

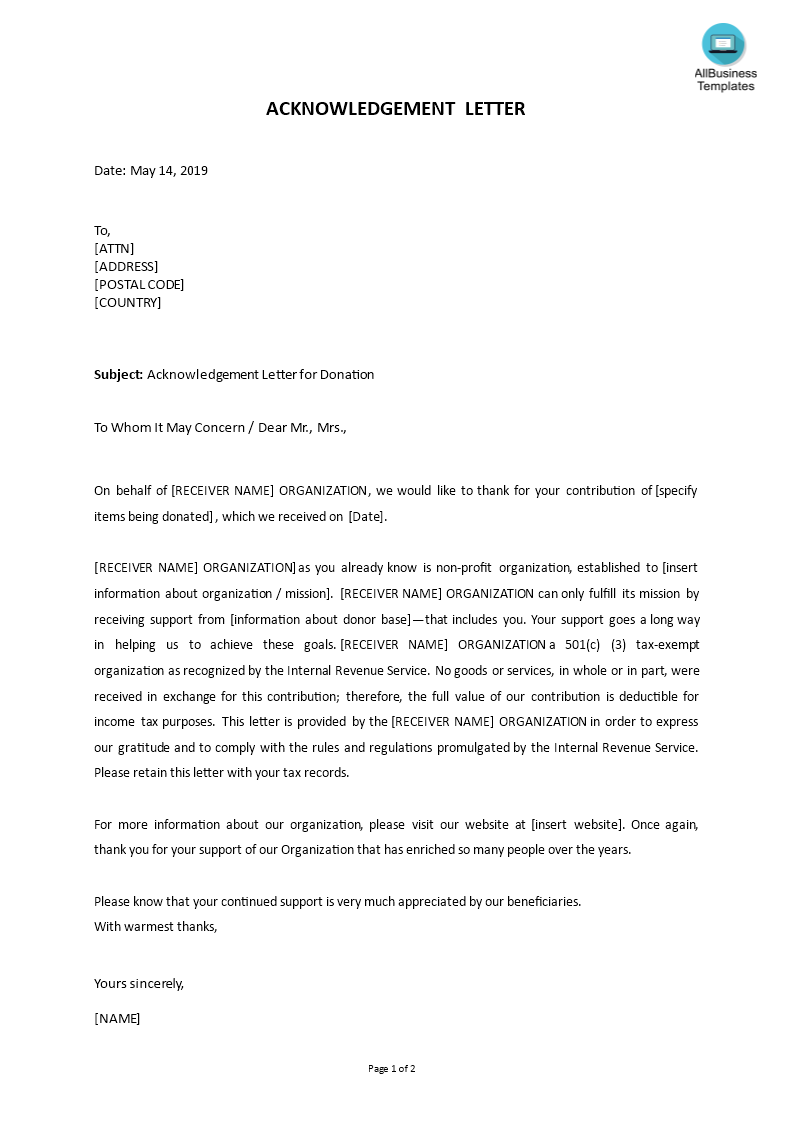

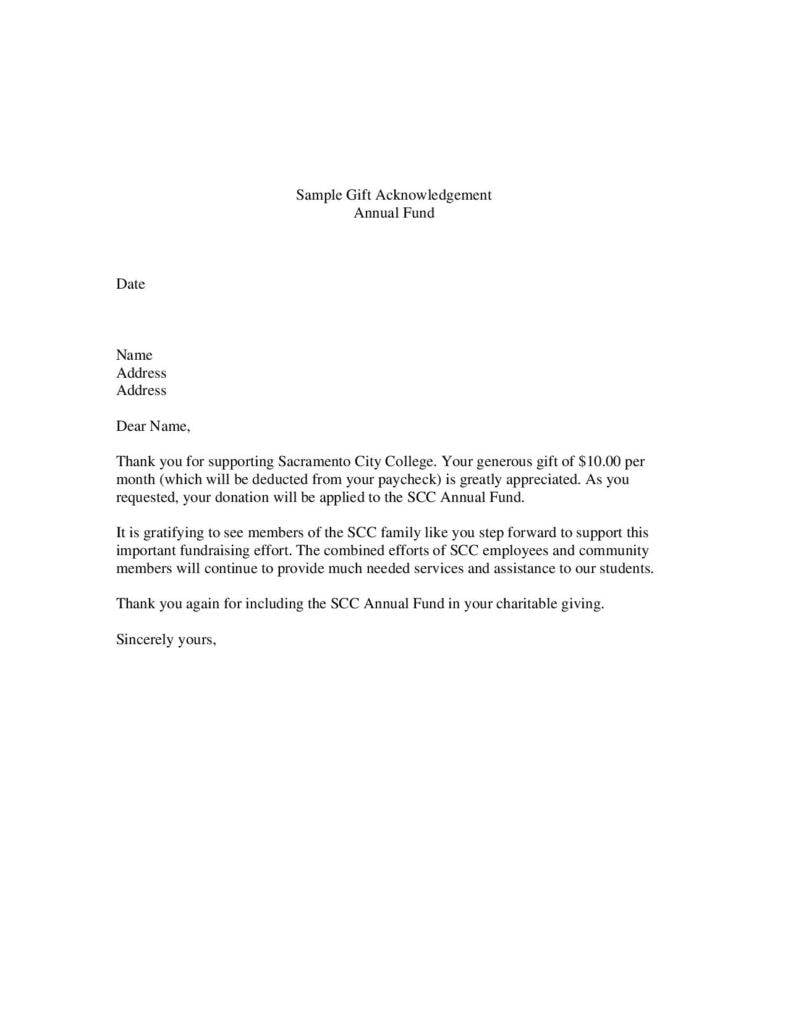

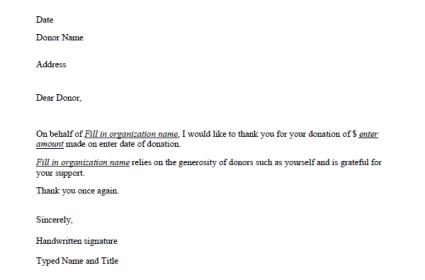

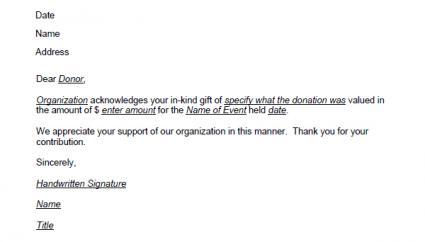

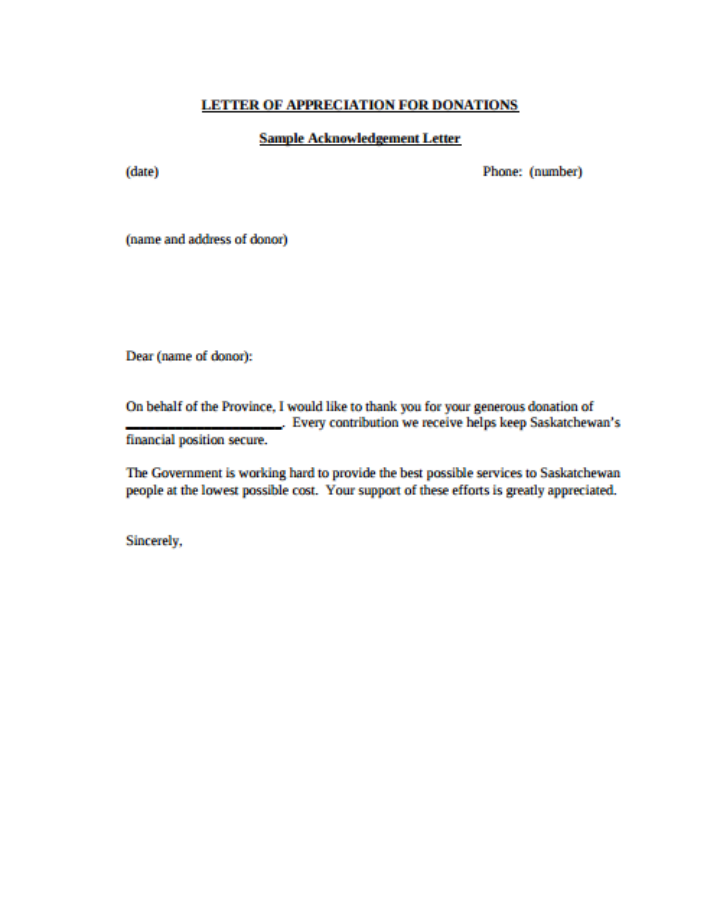

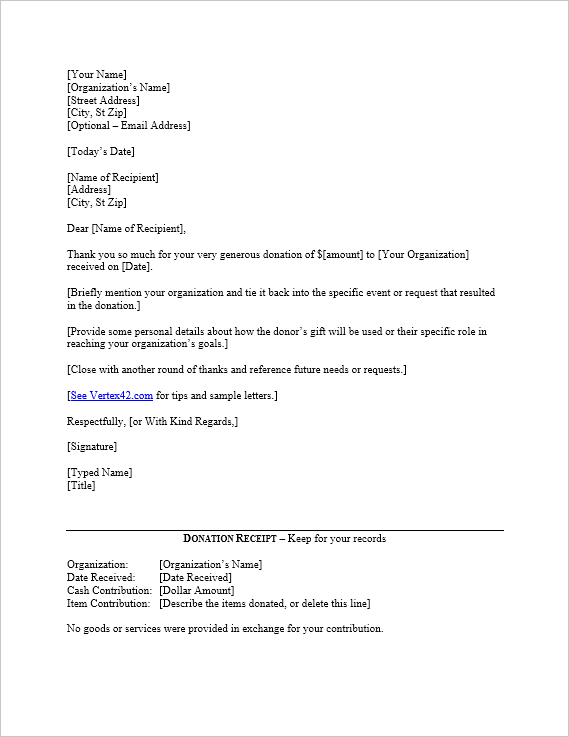

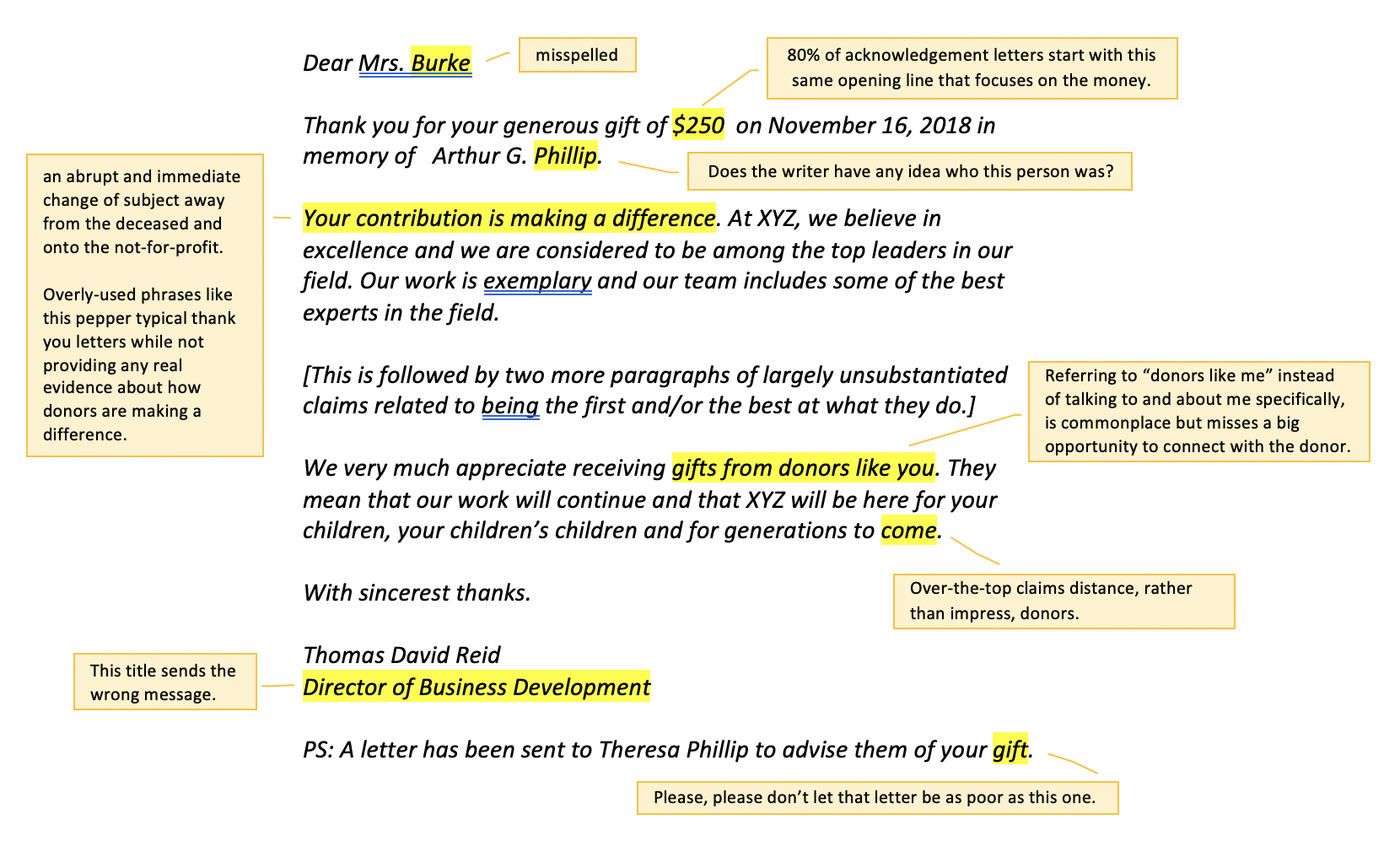

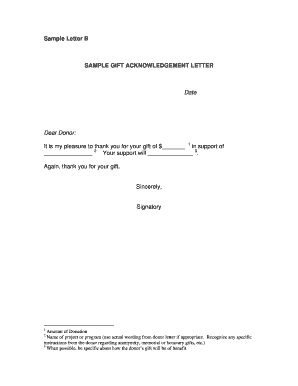

368 sample acknowledgement letter for donation. The donor acknowledgement letter template embedded above is an example of a donation acknowledgment letter that specifically includes wording for tax purposes. Letters also serve as a record of a gift and can often be used for tax purposes. Further things to consider when writing acknowledgment letters to donors. Even better we have a wonderful selection of sample letters for you to choose from in the event that you need a donation letter template of your own.

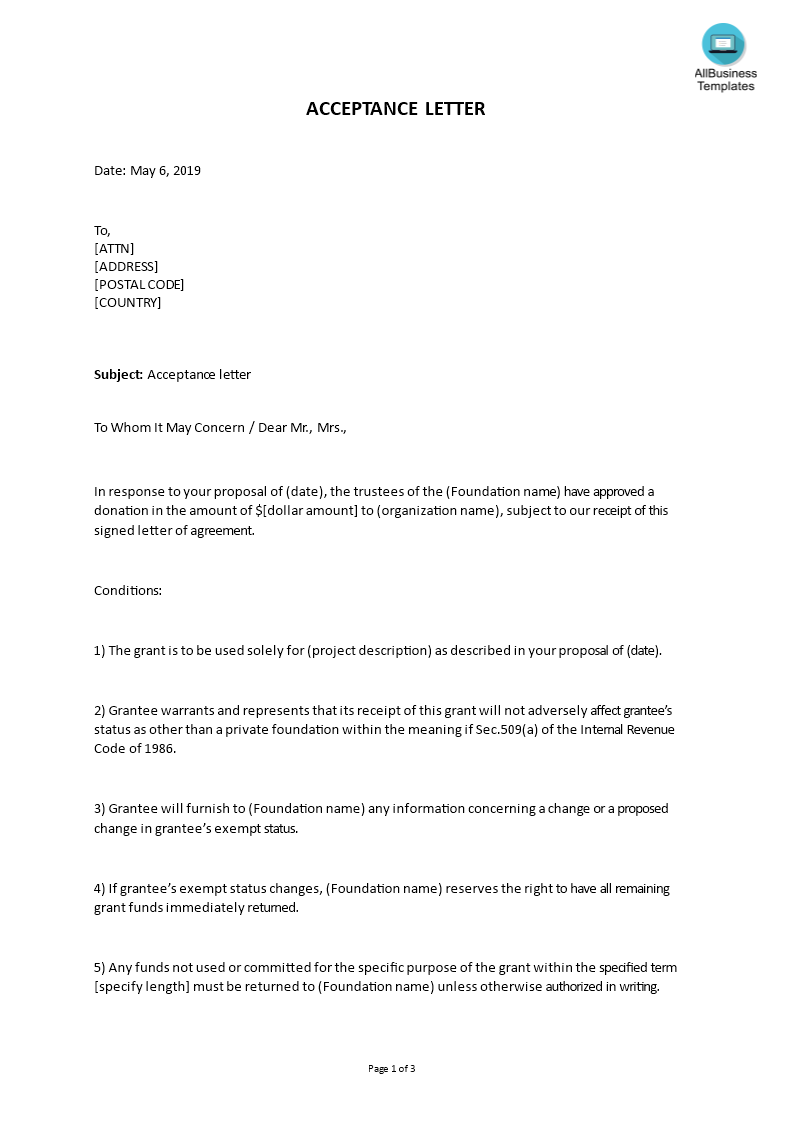

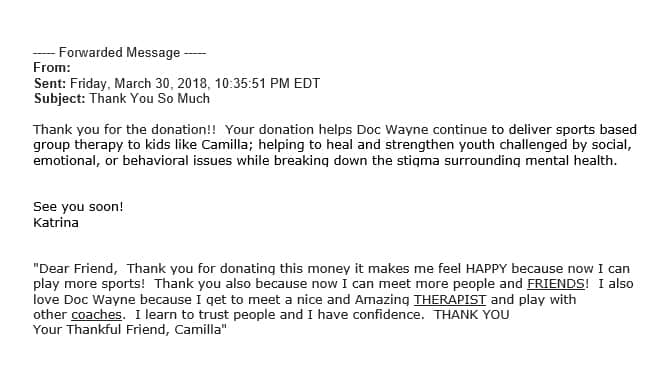

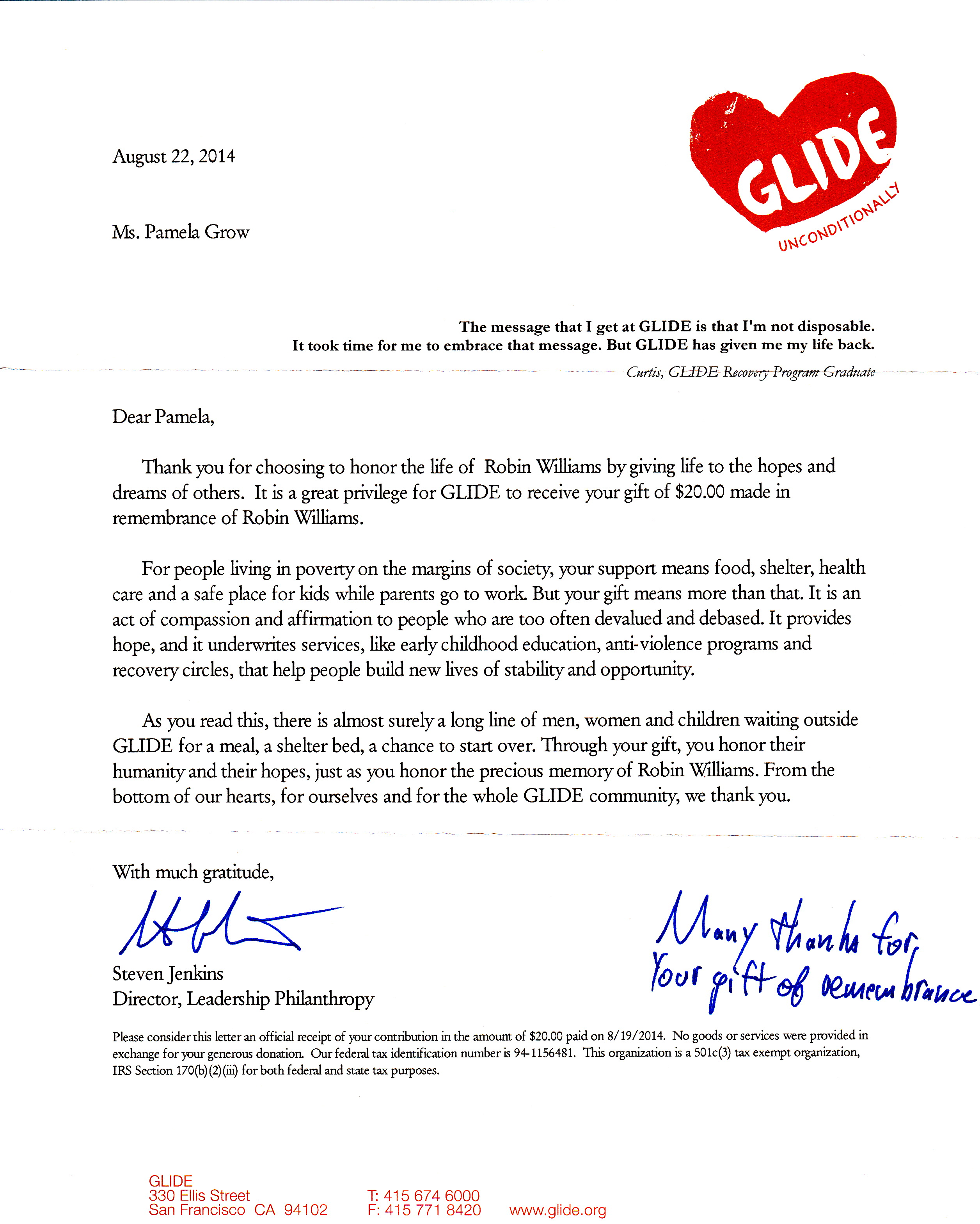

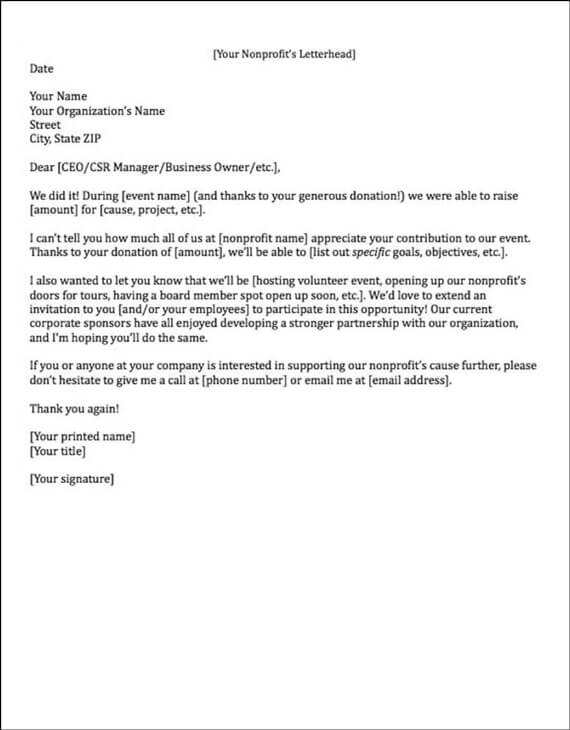

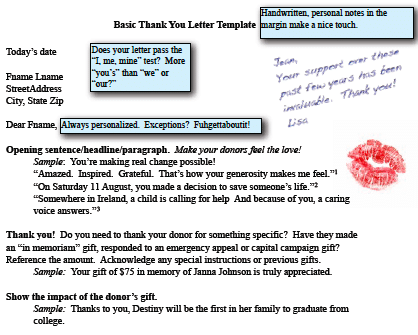

Steps guides to acknowledgement letter for donations received sample thank you donatiment of now you will find out the smartest ways to write an acknowledgement letter for donations received sample thank you donatiment of. Sample acknowledgement letter for equipment donation below briefly describe on sample acknowledgement letter for equipment donation. The letter confirms receipt of documents and highlights actions to be taken as requested in the letter. If your organization receives funding of any type following up with a thank you letter is a must.

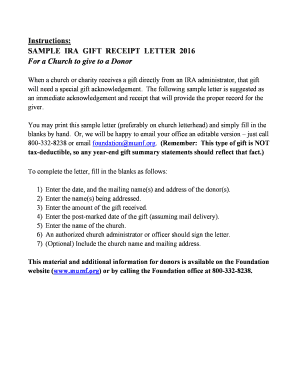

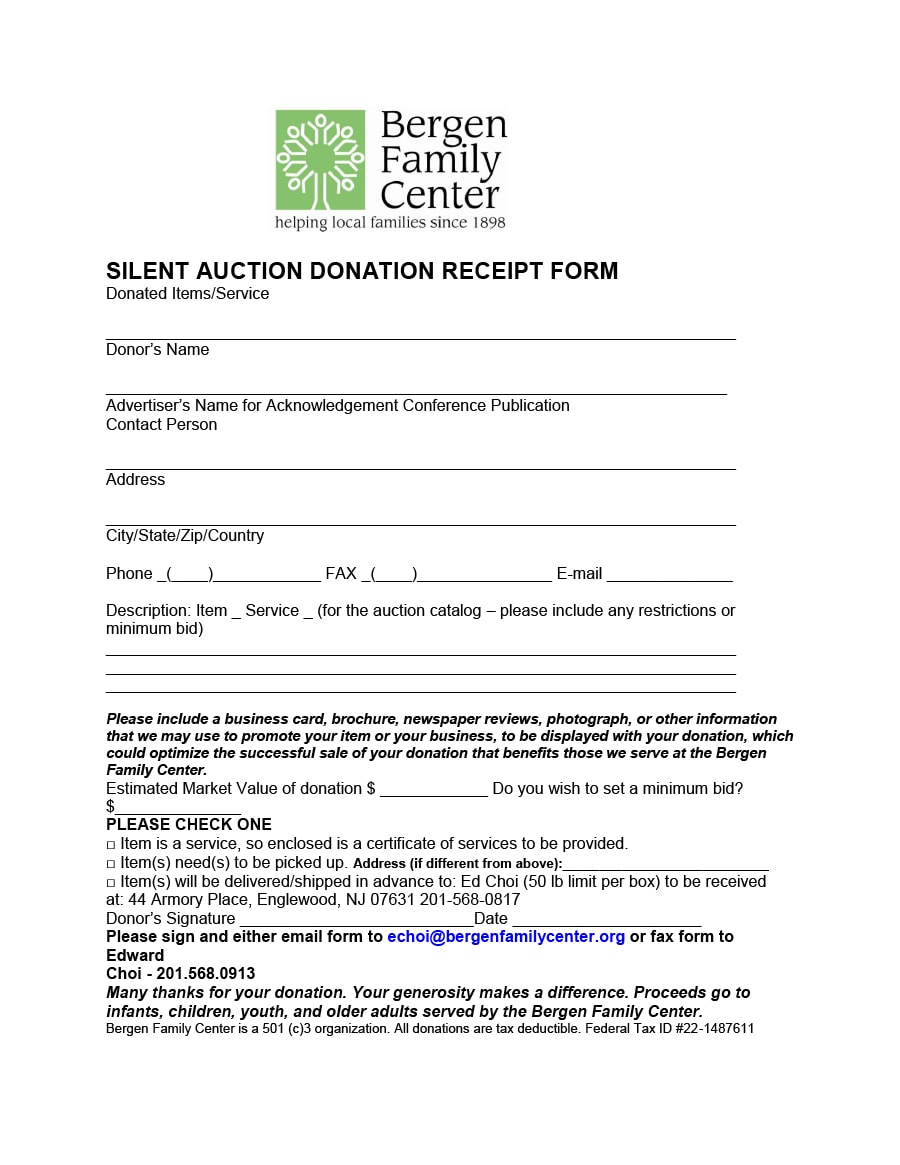

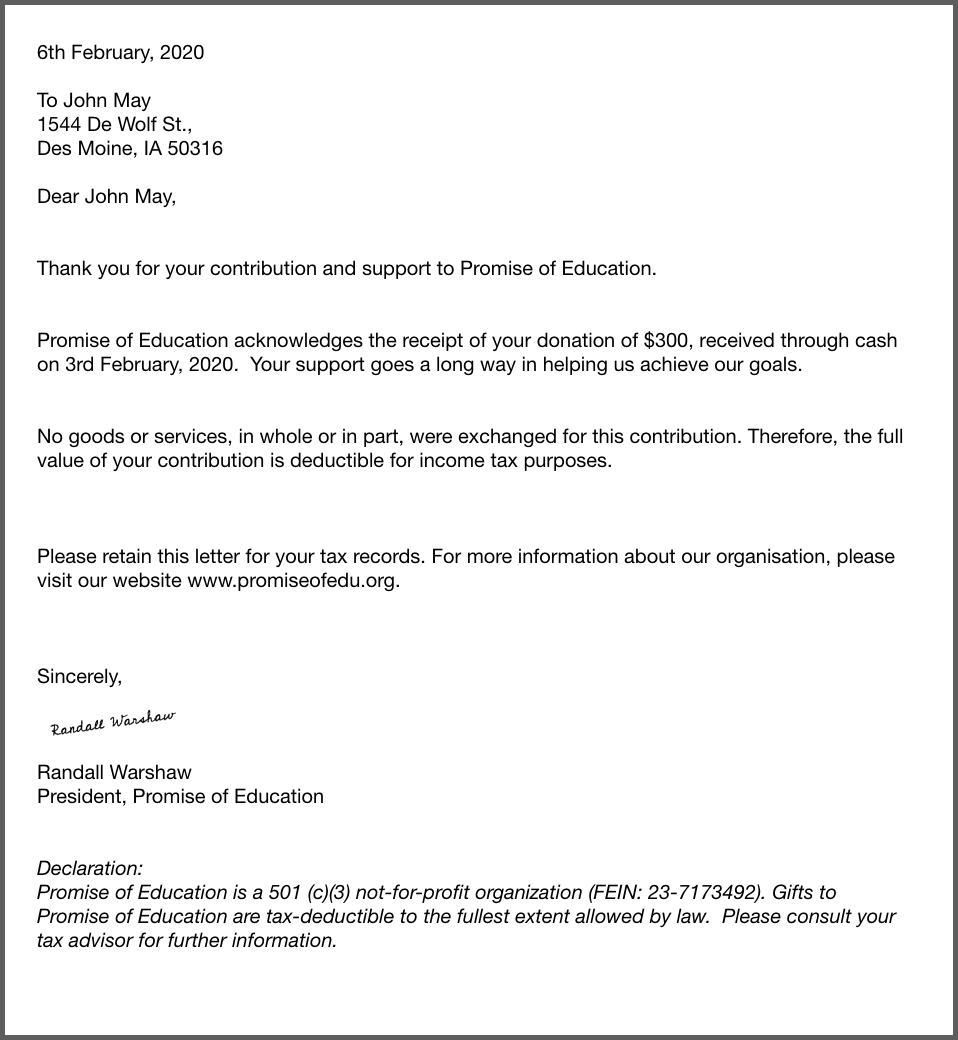

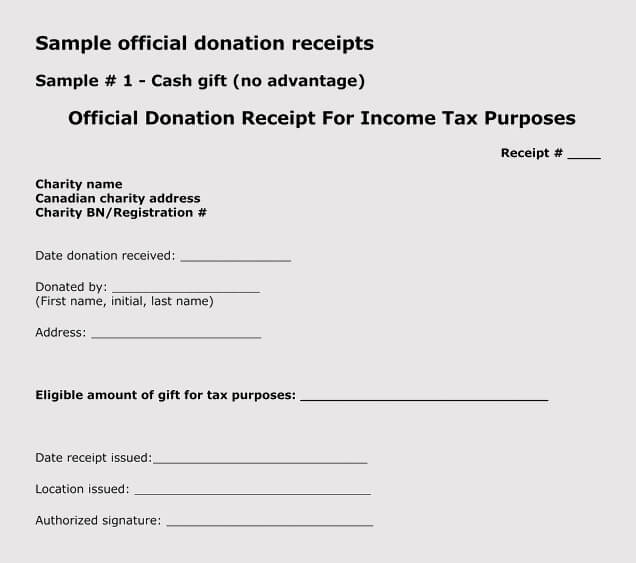

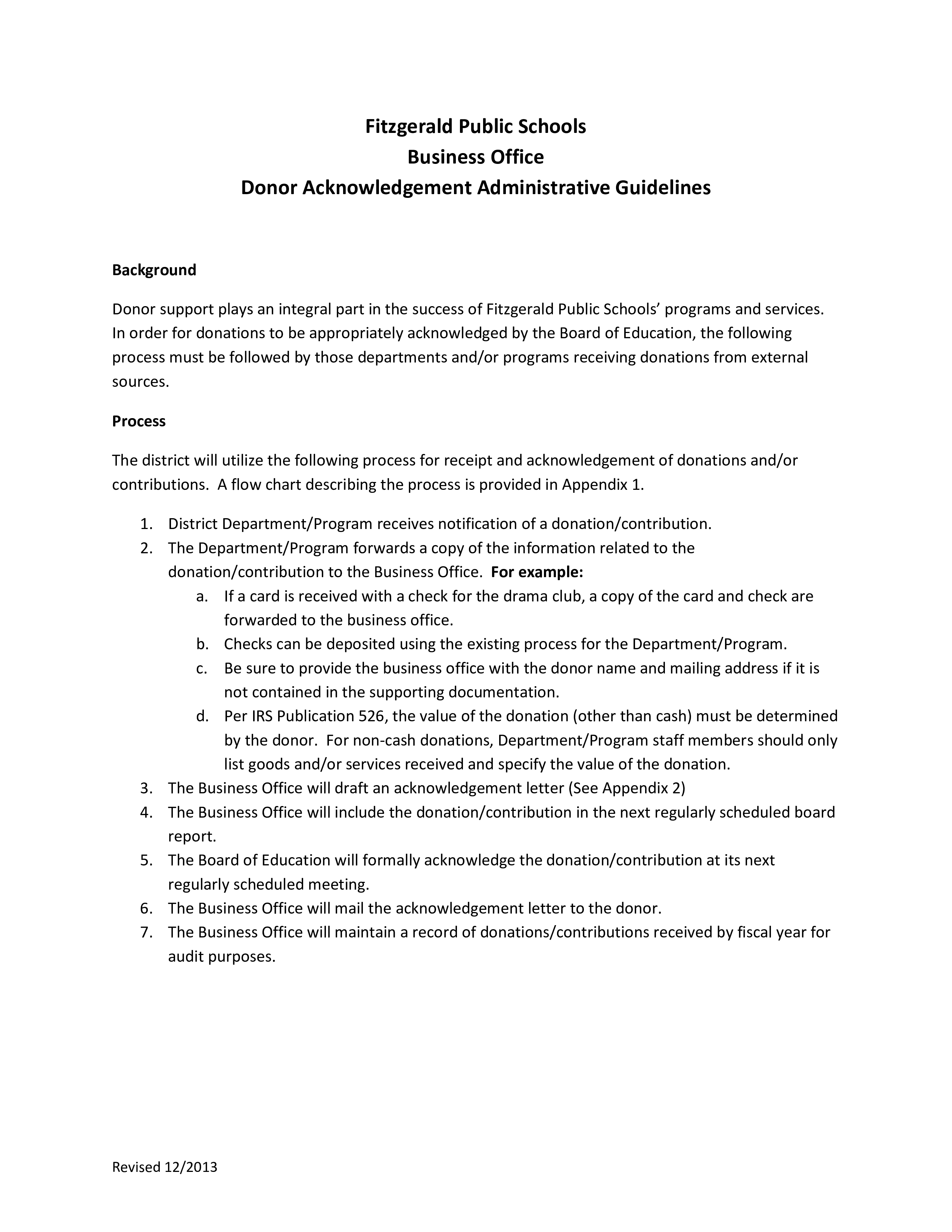

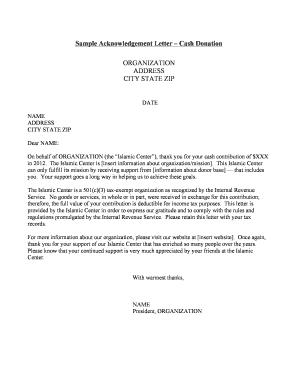

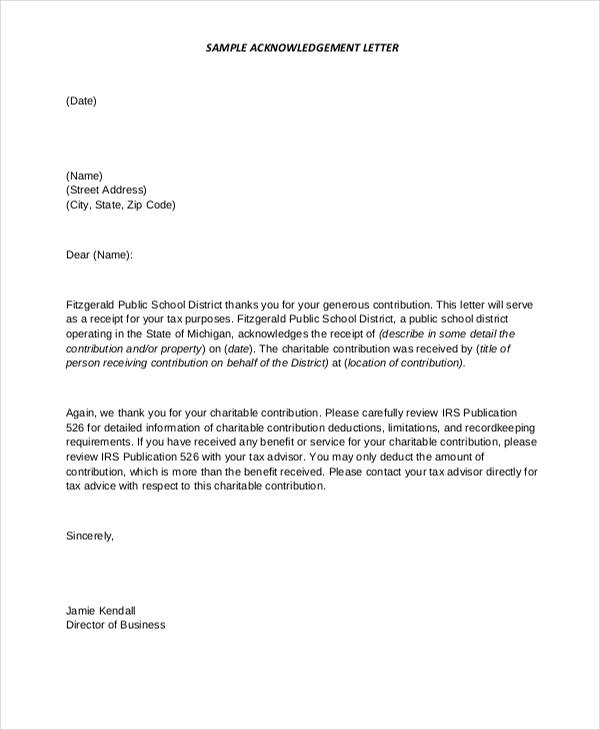

Nonprofits have certain requirements to follow including providing donors with a donation receipt often called an acknowledgment letter. Urgency is necessary when responding to. This is very helpful for organizations that want to cover all their bases and make sure that they are following the law. Learn what needs to be included in this letter.

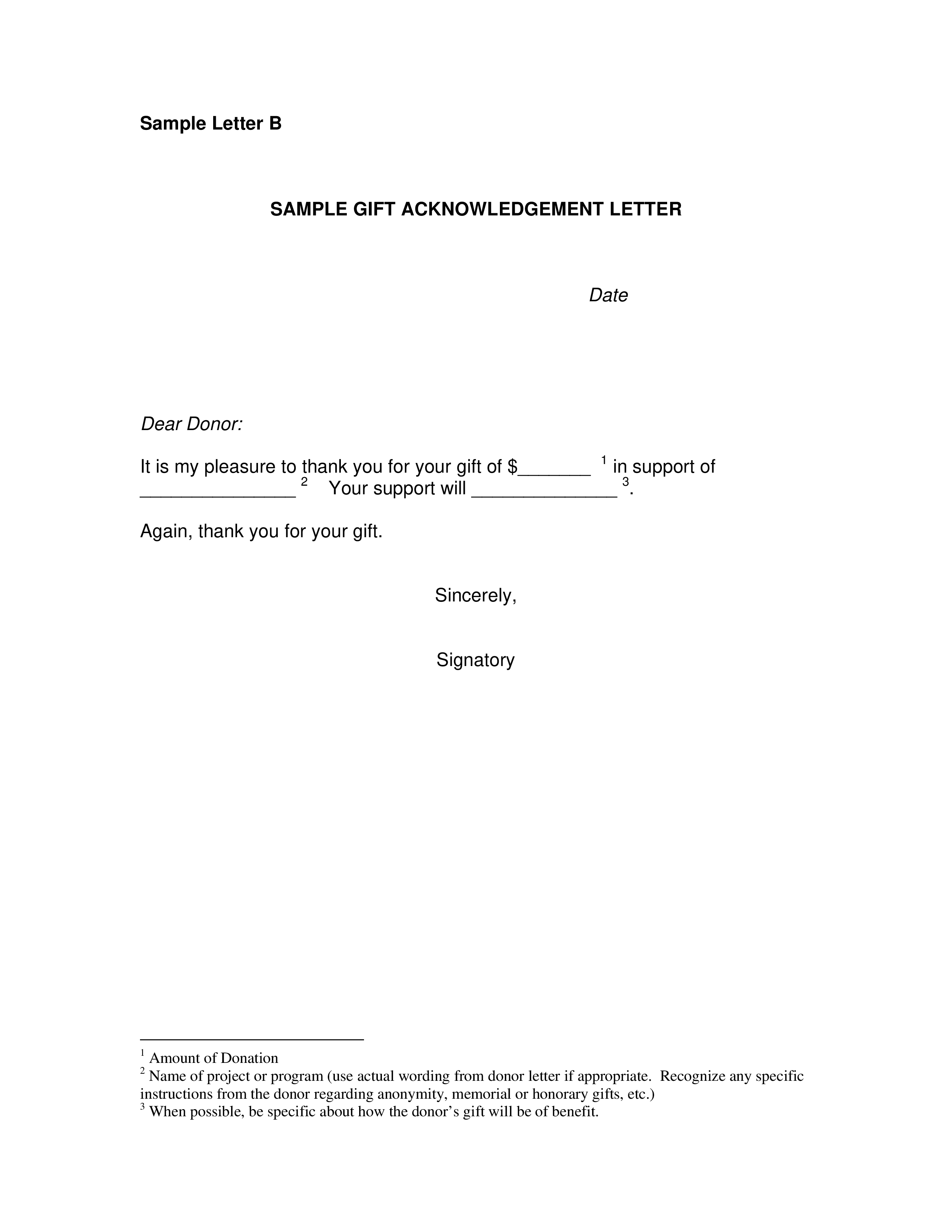

A donor acknowledgment letter is more than just a thank you letter. Acceptance letter acknolwedgement sample for a phd thesis acknowledgement acknowledgement letter acknowledgement page acknowledging appeal appeal letter application appraisal bachelor bachelor thesis business business plan cancellation complaint customer service debt definition dissertation donation estimate final report follow up form funds. The donor may use this letter as proof of his or her contribution and claim a tax deduction. This letter template also includes placeholders for names amounts dates addresses and nature of the donation.

In practice most charities send an acknowledgment for all donations even small ones. Acknowledgement letter for a donation. The irs requires public charities also known as 501c3 organizations to send a formal acknowledgment letter for any donation of more than 250. These letters are also part of legal documents.

2562 free letter templates download now adobe pdf microsoft word doc google docs apple mac pages microsoft excel xls google sheets spreadsheets. These letters serve as the receipt and should be sent as soon as the document. If you see there will be some steps of sequences that you have to take. It can actually be broken down to all the activities that the donation can cover or it can be a collective description of the group of people that can benefit from the donation and the activities that will already transpire because of the donation being given.

An acknowledgment letter is part of the normal day to day activities in the formal sector.